I spoke last night in the general debate on the economy, saying*:

As I rise to speak I am reminded of a quotation from an economist who was a fierce critic of Keynes, a chap called Henry Hazlitt, who said:

“Today is already the tomorrow which the bad economist yesterday urged us to ignore.”

We have heard today some moving accounts of individual and collective suffering in different regions of the country and among different sections of the public. We should be asking ourselves why, oh why, have we been delivered into this misery, which looks as if it will extend over years. Much of the conversation we have heard has been along the lines of aggregates, coarse economic aggregates, and has tended to stray away from individual choices and consequences. We have talked about markets in the abstract, and it is a pity that we seem to have forgotten that markets are a social phenomenon, and that they are about people co-operating. When we talk about markets, we tend to imagine overpaid people, high-frequency trading and those who add nothing to society.

I am reminded of something a constituent said to me recently after hearing a Minister’s speech. He asked, “Why is it that everything always seems to get harder for the working man, whoever is in power?” Indeed, in my constituency unemployment is up by 6.3% among the over-50s, up by 9.5% among those aged 25 to 49 and, scandalously, up by 23% among the young. We have heard that child poverty increased by 200,000 under the previous Government and that it is likely to increase by up to 100,000 under this Government. In the 21st century, that should not be our economic position.

Why are we in this debt crisis? I have just checked the M4 money supply figures—I am sorry to return to aggregates, but needs must. When Labour came to power the money supply was about £700 billion and it is now about £2.1 trillion, so it has tripled over the past 14 years. Unfortunately, most economists talk about money flowing into the economy as if it were water poured into a tank that found its own level immediately, but what if it is like treacle or honey? What if it builds up in piles when poured into the economy and takes a while to spread out? What if that money was loaned into existence in response to individual choices led by the excessively low interest rates pushed by the central bank? What if it was loaned into existence in particular sectors, such as the housing sector, where prices have more than doubled over the same period, and what if it was the financial sector that received the benefit of that new money first? Would that not explain why financiers and bankers are so much wealthier than everyone else, and why economic activity and wealth has been reorientated towards the south-east?

Unfortunately, the idea that money takes some time to move around the economy is lost on most economists, which I very much regret. Why did most economists not see the crisis coming? I put it to the House that it is because their theories of credit are mistaken. They make fundamental errors. Unfortunately I do not have time to go into that, but the fundamental point is that credit is a choice to consume more now and less later. It is about the exchange of present goods for future goods, and co-ordinating the economy through time, and I am afraid that the current intellectual mainstream in economics has dropped us into this desperate mess.

Opposition Members criticise the Thatcher and Reagan years. I think that there was much to applaud in those years, but unfortunately their intellectual underpinning was monetarism, which, like Keynesianism, is infected with those dreadful mistakes. People in the Occupy movement, and our constituents, are right to question the justice of our economic processes. The hon. Member for Penistone and Stocksbridge (Angela Smith) said earlier that the system cannot endure, and I am inclined to agree. I agree that the current debt-based and—I am afraid to say—statist system cannot endure. However, if this system is not to endure, which way should it fall? [Humanity] tried the statist direction in the past and it led to misery and murder. I stand for free markets and free co-operation, but I say this to the House: if this is capitalism, I am not a capitalist.

* (I have made a small correction to the quote and a clarification in [], both of which I have requested from Hansard)

Related reading can be found here:

- Hazlitt, Economics in One Lesson (buy, PDF), chapters 1, 6 and 23 in particular.

- Mises, Human Action (buy, online), especially chapter 20 “Interest, Credit Expansion, and the Trade Cycle”

- Hulsmann, The Ethics of Money Production (buy, PDF).

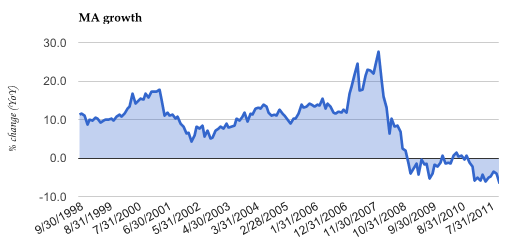

The Bank of England’s money supply measure M4, which I referred to, may be found here. I used M4 in this context because it is the conventional mainstream measure, but I prefer Kaleidic Economics’ MA for reasons explained on that site (Notes and Coins is too narrow and M4 too broad). MA tells a clear story of where jobs and growth came from and where they went – money supply growth created the illusion of prosperity, broke the banking system and collapsed, taking the illusion with it:

Update: Video here. My delivery picked up after about the first minute.

Excellent stuff.

But are any of your colleagues listening yet?

I’m a bit confused. Are you arguing that the current system we have, in which a large state (and the population at large) borrows today with no regard for tomorrow is capitalism? It is not.

We currently live under a corporate system, in which governments skew markets through a system of taxes and subsidies. Efforts to direct the flow of money in this way are fatally flawed – perhaps this explains that people who expect money to flow like water find it more closely resembles treacle. In fact, it is the effort to direct the flow that impedes the movement.

Excellent stuff indeed. I can’t believe that we have an MP who ‘pierces the veil of aggregates’ and reads Mises. It seems perfectly clear to me that the Austrian School have a much better explanation for the Global Financial Crisis than any Keynesian, but the press and the economics profession determinedly ignore their explanation. I suppose that there’s a natural bias towards Keynes in Westminster because he gives an easy recipe for ‘doing something’, whereas the Austrian solution of ‘doing nothing’ is never going to be a vote-winner.

Bravo, Steve! Tom, I think all Steve’s colleagues will have to listen before too long.

I have reached an age in life where I truly believe the adage “There’s nothing so bad that politicians can’t make it worse”.

Your unemployment figures illustrate my point – Sorry!

Steve,

Which way will it fall? Well, just imagine trying to crowbar power from the hands of certain groups and then realise for it not to be a Statist-driven outcome that step has to be almost if not completely successful.

I do think the only way is to have Free Banking, as in the ability for a plurality of currencies and full liability to those issuing same. Sterling and the BoE can remain as the currency used by the State if it wants to, but people should be free to not risk their wealth in that currency and only have to convert when paying taxes. Banks issuing currency would then take out their Sterling balances lodged at the BoE and vault them as their reserves or use that M0 to buy other hard assets such as, dare I say it, gold or silver. Whenever someone then tries to buy their new currency, the sterling can be vaulted or used to buy more gold. Of course, Sterling is likely to tank, but the new bank currency will appreciate and so constantly demand more and more Sterling per unit, still enabling gold to be bought to maintain reserves. The good will force out the bad.

The State will have a conniption for it will realise that the only way their promises were worth anything is because it enforced a de facto monopoly, a bit like the tokens issued by mill-owners to its employees for spending in the Company stores (at prices fixed by that company). We have now a Nationalised Mill Owner, the State. Worse for them being a monopoly that extends not across the geography of a town as before, but an entire country.

It has to end. It will, but, as you say, how is another matter and I fear greatly for the “little guy”.

I didn’t realise we actually had any intelligent and independent-minded MPs left. Even those with the nouse to realise the wisdom and common-sense in these words have thrown away their principles for personal advancement and greed. Steve I salute you and hope you go far in Government….I shall follow your blog from now on….

Bravo, Steve!

An MP who quotes Hazlitt and cites Jorg Guido Hulsmann as a source, not to mention Mises of course?!?!?!?! What is going on here?

There is hope for us yet.

Many thanks for this, Steve.

Let’s hope that all your colleagues read (or hear), mark, learn and inwardly digest!

Best wishes, and Marry Christmas!