Via The Telegraph, Will the great interest rate gamble pay off?

By the time this month’s auction is over, the ECB will have doled out nearly one and a half trillion euros of “free” money to help keep the banking system alive, with much more to come over the months ahead.

Nobody is under any illusions. These actions have not succeeded in vanquishing the crisis. Underlying structural issues remain unresolved, and it is most unlikely that the starvation diet to which much of the eurozone periphery has been condemned will result in robust recovery. But Mr Draghi has at least prevented the patient from dying on the slab. Two cheers for that.

During the IMF debate, I quoted Mises, who predicted the German hyperinflation:

The wavelike movement affecting the economic system, the recurrence of periods of boom which are followed by periods of depression, is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion.

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

Right now, it seems clear which path the western world has chosen. “The great interest rate gamble” will make our problems worse later. It’s an unhappy thought but denial will not help.

Here are ten plans which would deal with the structural problems in our financial system.

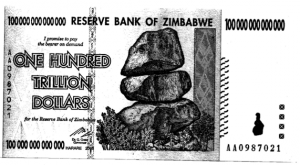

Update: I just discovered this Zimbabwe 100 trillion dollar note in my email. Amazing what governments will do.