Successive governments have incentivised people to buy ‘greener’ cars which use less fuel. Apart from outrageously high fuel duty with 20% VAT on top, the other tool has been Vehicle Excise Duty graded to promote low CO2 cars.

Having herded people down this road, apparently the Government now finds it cannot afford to lose the tax revenue. The Telegraph reports Drivers punished for going green:

The Daily Telegraph has learnt that government officials have begun private discussions with the motoring industry and drivers’ groups about an overhaul of the Vehicle Excise Duty (VED) rules.

The talks come as ministers try to prevent a fall in tax revenues as more motorists choose smaller, cleaner cars that incur a lower rate of duty. Labour has accused the Coalition of planning a “stealth tax” on drivers, effectively punishing them for going green.

I feel sure that my colleagues in government do not wish to apply arbitrary and capricious power to society, just as I have come to believe that Labour politicians don’t intend to destroy society itself. But to encourage one set of (expensive) behaviours with state power, only to change course when the inevitable consequences emerge is both arbitrary and capricious. Intentions have little to do with it.

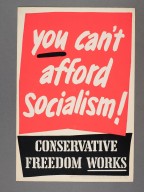

Once upon a time, this kind of thing would have been called a breach of the rule of law or even despotism. It seems to be the automatic consequence of persuading the public that the state can provide. The truth is just as the old poster says: you can’t afford socialism. Conservative freedom works. I sincerely hope we start trying it soon.

See also: my quick guide to the Rule of Law.

I think this is a rather one-sided and superficial point of view. Firstly, how do you define ‘outrageous’? I’m not really convinced that your opposition to high levels of duty/tax on fuel is based on real consideration of what is in the public interest. (You really need to provide a much more clear argument that fuel duty is higher than the level that best serves the public, taking into account both sides of the argument.) If people drove more and drove bigger, less fuel-efficient cars, there would be more pollution, more accidents and more congestion. Do you think people will be happy to live shorter lives of lower quality of life just because of the freedoms of selfish driving addicts? What about the freedom of cyclists and pedestrians? Go to China and see the roads crowded with huge gas-guzzling cars and maybe the disadvantages of low fuel costs will be more clear to you. Even Hayek surely supported the idea of state intervention in cases where people’s behaviour creates negative environmental externalities.

There is also a broader problem with excessive petroleum use – excessive dependency on oil leads to humanitarian problems. The leaders of China welcomed Omar al Bashir, a man who is wanted for war crimes and crimes against humanity, to Beijing as a ‘brother’. Why? Because China wants Sudan’s oil. And surely it is easy to find other examples of oil being put before people, e.g the various wars that are fought over countries that coincidentally have large oil reserves.

Also I find your argument about arbitrary and capricious power very weak. It seems like an argument against imposing any kind of tax or legal restriction. Surely, though, in a democracy, if the public wants a tax to be levied or even a freedom to be curtailed, it is right that that should happen? Your position seems to be that freedom for you and people like you is good but benefits for most of society are bad. What about the freedom of the majority of society to shape the evolution of society as it wishes?

I agree there is a problem that has happened because people have chosen to drive cars that entail less duty. But surely the solution is to raise duty on the most polluting cars? There are still people who drive such cars. We must remember also that surely cars are constantly evolving. No doubt in the future even more fuel-efficient cars will be invented and so if duty is well-designed people can be encouraged to move on to those. Besides, if the government still needs to raise money it can do so by raising taxes on wealth, particularly inherited wealth, surely the fairest kind of tax.

Hello Matthew,

Understanding the philosophy of liberty I think will help answer these questions, in terms of understanding where Steve is coming from..

http://www.youtube.com/watch?v=muHg86Mys7I

The notion that the government owns us, and our property, and can rightfully and retrospectively raise confiscatory taxes is counter to any libertarian principal.

Also – *who* decide’s what is “fair” and for the “public good”?

Millions of people through open, honest ree trade and exchange, or centralised power through force, restrictive regulation, frictional taxation, and threat of violence/imprisonment?

For more on how free markets can solve social problems see here:

http://www.learnliberty.org/

Hi Tom,

I’m very grateful for your reply and I will certainly look at that website carefully. I wonder if you can consider one idea though. The proposal that some have made to levy a one-off tax of 20% on the wealthiest 10% of the population in the UK to pay off the deficit reportedly enjoys support from 74% of the population (http://www.glasgowmediagroup.org/content/view/44/45/). (I accept that there are obvious big issues about the practicality of the proposal.) Therefore it seems like the overwhelming majority of people in the UK are actually calling out for the state to redistribute wealth, in other words they are willing to sacrifice their freedom to the state to give the state the task of bringing about an outcome which they believe to be in their interest. Shouldn’t the freedom to voluntarily give up one’s freedom be a freedom too? (You might say: well what about the freedom of those wealthiest to keep their assets? But since many of those acquired those assets through means that are arguably unjust (e.g. the lottery of inheritance) that freedom is arguably not very significant.)

I also think you might want to consider the argument offered in this article: http://www.guardian.co.uk/commentisfree/2010/jul/07/emergency-budget-tax-fair

You might also want to look at this discussion: http://crookedtimber.org/2012/05/30/not-so-new-applications-in-the-quantitative-analysis-of-textual-information/

Hi Matthew,

I think the notion that it is the state’s money to confiscate, after the fact, that is alien to me (and I’d say all libertarians too).

e.g. Say a group in your street organised a spending binge and threw a fantastic party, and then afterwards got the majority of residents on the street to vote to confiscate money from the richer residents (some of whom did not attend) to pay for it all. That is just naturally wrong to me. It is everything that is bad in human nature, populist spite, and envy. Isn’t this analogous to the suggestions in your links?

If a sheep, and 2 wolves voted for what to eat for dinner – the outcome would already be known. That doesn’t however make it, the outcome, “right” at all. Nor does it mean democratic decisions always lead to outcomes that are “right”.

Cheers,

Tom.