Brought forward from August last year. People on ordinary incomes still pay too much

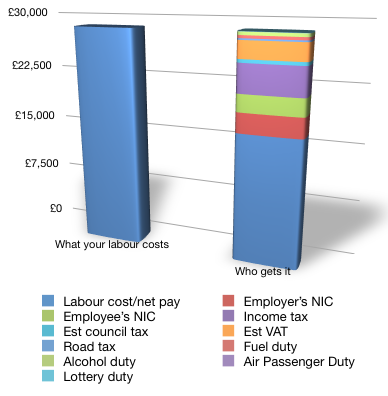

Each employee’s labour costs their employer a certain amount: their salary plus employers’ National Insurance Contributions (neglecting other benefits). How much does the employee actually receive to spend as they see fit?

As a guide, we looked at the figures for a single man employed full-time, making median gross annual earnings. He saves nothing and spends the average percentage of his earnings on goods and services rated for VAT at 20% and 5%. He shares an average (band D) property with two other people. He has an old Astra and fills it up once a month.

He buys one pint of beer per day on average and buys his girlfriend one bottle of wine per week. He takes one short-haul foreign holiday per year. He spends a fiver a week on the lottery. He does not smoke.

Here’s what we found: if our man is on a gross salary of £26,100, he costs his employer £28,652.31 a year but spends just £16,731.21 on goods and services. That is, 46% of the product of his labour goes to the state, one way or another.

No doubt our man receives benefit from public services which he enjoys, and certainly he should make some contribution to the welfare of those who cannot help themselves, but 46% spent according to the wishes of politicians and officials? It’s hardly freedom.

I’m reminded of a quote from the magazine of The Oddfellows Friendly Society on the eve of the 1911 National Insurance Act:

Working men are awakening to the fact that this is a subtle attempt to take from the class to which they belong the administration of the great voluntary organisations which they have built up for themselves, and to hand over the future control to the paid servants of the governing class … This is not liberty; this is not development of self-government, but a new form of autocracy and tyranny not less but the more dangerous because it is benevolent in its intentions. (Oddfellows Magazine, September 1911, p. 544)

Now that’s the kind of attitude amongst the public for which I yearn. I suspect there would be more complaint if PAYE and taxes on spending didn’t hide the true cost of the state. The Government proposes to increase tax transparency and there is already an online tool and a mobile application (which neglects several taxes). You can find out more here.

For proposals to substantially reform the tax system, see 2020tax.org. To see where you fit into the UK income distribution, use this calculator from the Institute for Fiscal Studies.

I earn ~24k pa and worked out the same for myself (i.e. how much I actually pay in tax compared to the cost to my employer of employing me). The figure came to over 52% (I included TV licence as a tax). I find it absolutely disgraceful that government can conficate over half of a person’s income, when that person doesn’t even earn the median wage.

Most people would be happy to pay ~20% tax on their earnings – the problem is that most people think that they do.