“So weak!” or “So what?” – David Cameron was pretty clear what he heard Ed Balls say at the time… Whichever, it set me thinking about flat tax.

What if income tax:

- Had a single, flat rate?

- Had a generous tax-free allowance for every individual?

- Applied to all income, not just employment earnings, and the rest of the system were simplified?

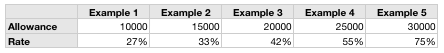

So, for fun (!), I put together a model, quite possibly naive and certainly completely unverified against the facts of Britain’s income distribution, to explore these examples, which each raise the same amount of tax:

The assumed income distribution was from £5000 to £100,000 in £5000 intervals, with a mode at £25,000, a normal distribution and a total working population of 30 million. Each of these examples raised around £200 billion in tax.

The income distribution and tax taken were not verified: it was too late in the day. I may refine this study in due course, but for the moment, it’s merely an interesting fag-packet sketch which raises a number of lessons and areas for further exploration.

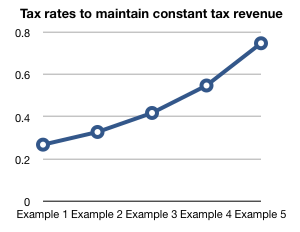

The first observation is that the increase in the rate of tax required to raise the same tax revenue is non-linear. For example, raising people’s tax-free allowance from £20,000 to £30,000 means the tax rate must rise from a painful 42% to a punishing 75%:

The diminishing number of people on the higher salaries means that higher allowances require radical and unconscionable increases in the flat rate of tax.

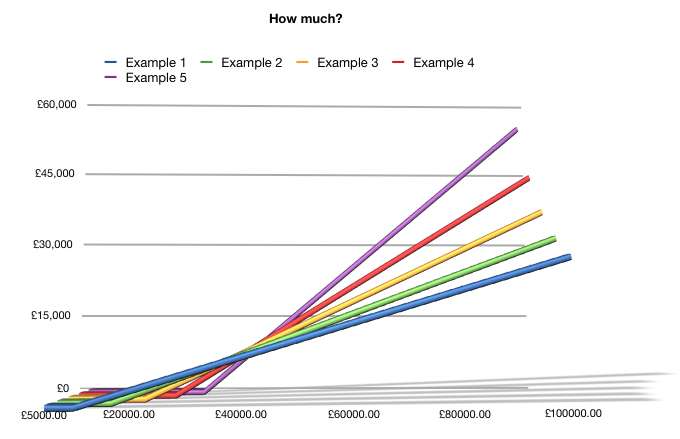

So how much tax do you pay according to income on these examples?

It is apparent that generous tax free allowances imply gross disincentives to higher earning. If you can live in some comfort on £35,000 a year, making £60,000 is almost certainly not worth the effort just to add £6250 a year to your net income. This extreme example merely illustrates the point.

A corollary is, flat tax only works if you are prepared to tax the majority. Any government wishing to “make the rich pay more’ – um, that’s what percentages do, but never mind – is compelled to extinguish the flame of aspiration under a flat tax scheme.

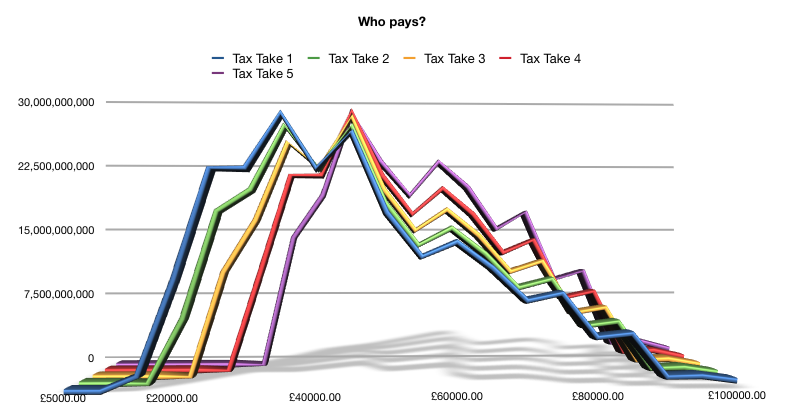

And which income bands does the tax revenue come from?

So, whatever you do, it appears the same people pay most of the tax. You just can’t raise most of your tax from the higher earners unless you are prepared to raise very little. So, rather than making collectivist gestures, perhaps all individuals could be made equal before the tax system, with the exception of the very low paid, whose income would be exempt for the sake of compassion.

It seems that, for any fixed tax take, there’s always the same group paying most of the tax, whatever the rate and allowance, and this group is the middle class.

It may be that reducing tax avoidance by the rich is irrelevant. A further question would be the effect of the rich reducing their tax avoidance: it appears that there are relatively so few rich people that it would be a minor factor.

Furthermore, it may be that if the mode income increases, the tax rate can be cut while raising more tax…

A related finding, running through this exercise, is that it is far too easy to slip into setting target tax revenues. The public sector is not suited to cutting its cloth to its means: how do we rebalance tax so that the public sector shares the burden of economic fluctuation? And should we?

My advice for flat tax schemes? Make the allowance something less than the mode, or perhaps mean, gross income and pick a rate that tends not to disincentivise.