I have been asked to explain reasons for the changes to Employment and Support Allowance (ESA) as set out in the Welfare Reform and Work Bill and the debacle over Personal Independence Payment (PIP).

I have been asked to explain reasons for the changes to Employment and Support Allowance (ESA) as set out in the Welfare Reform and Work Bill and the debacle over Personal Independence Payment (PIP).

In the Summer Budget 2015, the Chancellor announced that, from April 2017, new ESA claimants who are placed in the work-related activity group (WRAG) will receive the same rate of benefit as those claiming Jobseeker’s Allowance (JSA). This change only affects new claims made after that date, not those already in receipt of ESA.

As I was advised in a letter from the Secretary of State for Work and Pensions:

The record employment levels and strong jobs growth in recent years have benefitted many, but these benefits have yet to reach those on ESA. While 1 in 5 JSA claimants move off benefit every month, this is true of just 1 in 100 of ESA WRAG claimants. Those with health conditions and disabilities deserve better than this.

It is important to tackle this as in addition to providing financial security for individuals, there are economic, social and moral arguments that, for those who are able to, work is the most effective way to improve the well-being of individuals, their families and their communities.

Those in the WRAG currently receive additional cash payments but little employment support. As the Prime Minister has recently stated, this fixation on welfare treats the symptoms, not the causes of poverty and over time it traps people in dependency as, in the current system, the additional cash payment acts as a disincentive to moving into employment. That is why the Government are proposing to recycle some of the money currently spent on cash payments, which are not actually achieving the desired effect of helping people move closer to the labour market, into practical support that will make a genuine difference to individual’s life chances.

This new funding will be worth £60 million in 2017/18 rising to £100 million in 2020/21. It will support those with limited capability for work to take steps to move closer to the labour market, and when they are able, back to work. This additional practical support is part of a real terms increase that was announced at the Autumn Statement. How the support will be spent is going to be influenced by a Taskforce of representatives from disability charities, disabled people’s user-led organisations, employers, think tanks, provider representatives and local authorities.

It is important to improve what is on offer for these individuals because we know that most people with disabilities and health conditions want to work, including 61% of the WRAG, and there is a large body of evidence showing that work is generally good for physical and mental wellbeing.’

These changes are a re-allocation of funds to offer better support to enter work where possible for the good of the individual and their community. In that context, I look forward to a successful package of reforms.

PIP was introduced to be a more modern and dynamic assistance package to help cover the extra costs faced by disabled people. Unlike Disability Living Allowance (DLA), PIP is designed to focus support on those with the greatest need. Under these changes, 22 per cent of claimants are receiving the highest level of support, compared to only 16 per cent under DLA. The cost to the taxpayer of these benefits has increased more than anticipated.

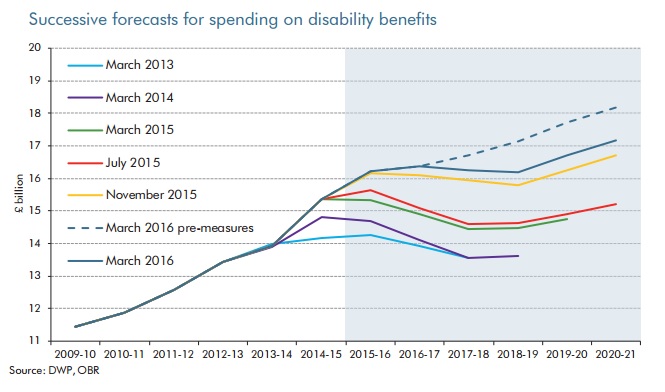

When the Coalition Government came to power in 2010, annual national expenditure on disability benefits was about £12 billion. This has now increased to about £16 billion – an increase of a third. With the Government introducing the Personal Independence Payment (PIP), this number will reach about £18 billion by 2020-21.

The following chart from the latest Office for Budget Responsibility Economic and Fiscal Outlook explains how successive forecasts have increased:

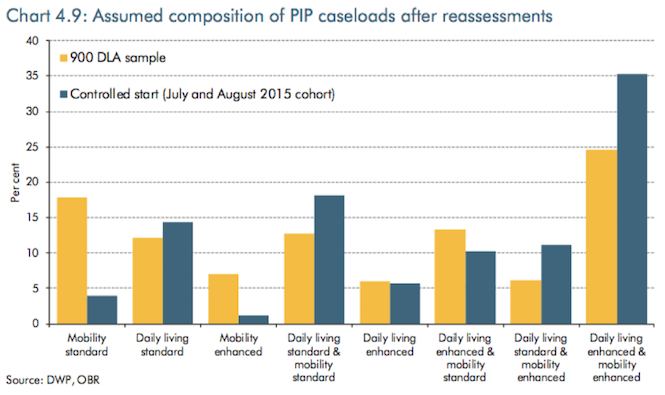

The Government attempted to contain these increases with measures in the Budget. The OBR revised up average awards by 16% with the latest evidence indicating a significantly higher proportion of claims being awarded the enhanced daily living and mobility payments as follows:

Bringing forward these changes alongside tax cuts was a mistake that the Government reversed. Speaking in a time-limited debate on the Budget, I said:

I rise to support the Budget and, in particular, to welcome the Government’s supply-side reforms. This has been a dramatic Budget, and I would be failing the Government if I did not concentrate on the areas of drama. First, on the disability reforms, the challenge before the Government is clear: to deliver a policy that we can all be proud to defend in our constituencies and in front of any objective scrutiny. I do not think we would have been able to do that if the Government had not wisely made the decisions that they have over the past few days. When I look at page 150 of the OBR’s report [above], on the successive forecasts for spending on disability benefits, I can see that the Government’s envelope within which to deliver this humane disability policy is very clear. When we came to power in 2010, the Government were spending £12 billion on disability benefits, which rose to £16 billion by now, which is an increase of a third. The figure is forecast, with the reversal of the PIP measures, to reach £18 billion by 2020-21. It is clear that the Government have an envelope within which to work to ensure that we have a world-class policy that any of us can defend, even in an environment of fierce and partisan political attack.

I now look forward to the Secretary of State bringing forward a package of support for disabled people which can be defended against all objective criticism.