A so-called “mansion tax” may appear to embody a particular notion of fairness. One would think from the rhetoric that high-value homes all belonged to wicked billionaires, oligarchs and non-doms. One would think that owning such a home were inherently unjust. Far from it.

Many valuable homes will have been bought by hard-working individuals and families using mortgages paid over many years. They will have paid tax on their incomes and capital gains. Hitting them again in this way would be double taxation and double taxation based on apparently prudent choices at that.

New taxes based on asset values are a retrospective form of wealth confiscation to which people did not know they would be subject. People already pay 5% stamp duty on high-value homes, 28% capital gains tax on second homes and 40% inheritance tax. Substantial capital taxes are already in place: a further “mansion tax” is not justified. Further, it would punish people on modest incomes whose often simple houses have rapidly increased in paper value for reasons outside their control.

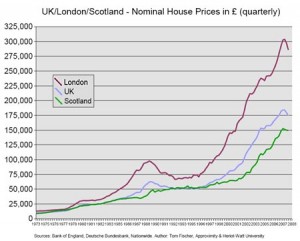

Between 1997 and 2010, the broad money supply tripled and, unsurprisingly, house prices sky-rocketed. Interest rates were too low for too long and the resulting credit boom artificially inflated asset prices and created the illusion of prosperity before, inevitably, dropping us into this mess. Having created that injustice against the propertyless with one arm of the state, another arm might now tax unrealised increases in house prices, taxes which many would not be able to pay without selling up: many simply do not have sufficient income.

One person’s so-called mansion on paper could be in practice someone else’s flat in London. Our chronically inflationary monetary arrangements have driven up prices in some areas even as others have been impoverished. Why should people pay for accidents of geography? Why should people pay for the consequences of increased demand as foreign buyers seek havens from their own collapsing currencies?

The supposed fairness of a mansion tax no doubt has its roots in the erroneous philosophy of the American political economist Henry George. Georgists believe that people are entitled to the fruits of their labours but that they are not entitled to own original factors of production — land — which is considered to be owned by society in the person of the state.

The Georgists’ solution is a tax on the value of land itself to prevent private owners from gaining a profit by merely owning it. That tax would of course distort the market for real estate, arguably producing chaos (or perhaps worse chaos than we have).

Georgism is an old error, refuted many times, which seems never to die. If you cannot obtain property in land (the original factors of production), you cannot obtain property in the fruits of your labour. Those who want a full refutation can find it in, for example, Rothbard’s treatise Man, Economy and State (PDF) or in this essay. I’m sure there are other sources.

A mansion tax, indeed any wealth tax, would be an arbitrary, unjust and counterproductive tax on success and prudence. It would render secure householders insecure. It is based on the erroneous notion of comprehensive communal entitlement to land. It would introduce further discoordination and uncertainty into real estate markets.

Such taxes should certainly be opposed.

I do worry when I agree with you Steve, but it sometimes happens. There’s a whiff of “dangerous dogs” about this rush to find ways to punish the wealthy, which I guess is also why we won’t be seeing the back of the 50p tax rate for a while.

I can see the logic behind the ‘Georgist’ approach. I’m not sure it would be an ‘error’ as such, It seems to be based on a reasoned but flawed ideology – but I am sure that the British public would ultimately not be in favour of it .

If we accept that we’re going to go on having a mixed economy – and I think most people do, and we accept that there is nothing intrinsically wrong with making a profit, and accumulating at least some degree of personal wealth – and again I think most of the political spectrum does accept this. Then surely punishing people for doing well doesn’t make any sense in the longer term, No more sense than taking more than half of someone’s earnings in income tax – I don’t think the 50p rate harms industry or commerce, but I do think it crosses a psychological barrier – if it’s right to make money – to earn a wage or make a profit, then surely the individual should get to keep the majority of that money ?

I’m surprised my Tories aren’t saying that, and I’m surprised there aren’t at least a few Labour supporters saying it either.

> my Tories

Hmm … should have read ‘more Tories”

It’s NOT a Freudian slip – OK ?

And to say nothing of the impracticalities of collecting such a tax. A vast army of assessors to value all houses and since values change constantly, this would have to be done on a regular basis. Another army to deal with disputes etc. I might ask also what happens if I decide to break my hypothetical mansion up into smaller units. How would introducing thresholds distort the market – would people trade down or move out to less prime areas? It really hasnt been thought through has it.

I don’t buy the Georgist argument that land is special, but I was a bit disappointed with that Rothbard essay. At times it seemed like sophistry.

I don’t think Rothbard understands Georgism at all. He writes as if Georgists are advocating taxing the entire rental value of land, but in fact Georgists oppose taxing value added to the land by man-made improvements. So proper Georgists oppose a mansion tax.

Simon Rigelsford is right. Proper Georgists are ambivalent about or outright oppose a mansion tax. They advocate a tax on the leasehold rent which is almost certainly charged for the land upon which the London “mansion” is built. Since the “mansion” owner is already paying this to the freeholder, it would cost the owner nothing more than he was already paying.

On the broader subject of the benefits of a Property Tax, I think it relevant to point out that this was the only major tax charged from the late 17th until the early 19th century, a period during which Britain prospered mightily despite the costs of industrialising, of growing a global empire and latterly of fighting a war against France. It was only after the Property Tax began to be replaced by the Income Tax (and its later cousins, Corporation Tax and Sales Taxes) during the 19th century that Britain’s fortunes began to dwindle.

The lesson from that historical experience should be that we need to replace the current business-hostile taxes with the business-friendly property tax regime that we had in the 18th century if we truly want to restore Britain’s international competitiveness.