It’s time to privatise commercial risk in banking and insist on prudent accounts. Government should:

- Eliminate moral hazard from the financial system by implementing this measure to make bank directors strictly liable without limit and to treat as capital both directors’ personal bonds and, for five years, the bonus pool.

- Introduce prudent bank accounting so banks can’t game the rules using derivatives to manufacture illusory profits from unrealised cash flows.

The banking system isn’t capitalist

It’s not capitalism when private individuals stand to gain from their actions but the taxpayer carries the risk. When risks are socialised and potential profits huge, individuals are bound to be reckless: why be responsible? It’s no good agonising about the culture of banking without considering the astronomical moral hazard endemic in the system today. Of course people who do not have to bear the negative consequences of their actions behave badly.

The truth is as Sir Mervyn King said in his 2010 Bagehot lecture (PDF): “Of all the many ways of organising banking, the worst is the one we have today.” Here’s why:

- Profits are privatised and risks socialised, creating incentives to be reckless.

- The entire interest rate market is deliberately manipulated by the central banks to promote or restrain lending and saving.

- Government has a monopoly on money and legal tender laws enforce it.

- Fiat money – paper promises to pay and accounting entries corresponding to new loans – means that there is no effective restraint on the creation of new money by banks.

- The banks own the money in your current account: they fund themselves from money which they owe you immediately on demand.

- To deal with the problems created by banks funding themselves out of your current account, there’s taxpayer-funded deposit insurance and a lender of last resort. As the Bank of England admits, that means public subsidies which could be worth over £100 billion to UK banks plus an overblown financial system which draws resources from other sectors.

- The system has been tightly but badly regulated for years. Anyone who thinks banking has been laissez-faire hasn’t worked in a bank or a regulator, tried to start a new bank or looked at the regulations.

The result is a centrally-planned, taxpayer-backed banking system in which money is loaned into existence by institutions which are systematically encouraged to be reckless by bad regulation. That’s why there was a tripling of the money supply between 1997 and 2010 in a vast credit boom which was bound to burst. That’s why individuals were prepared to manipulate market prices for unjust personal gain.

The next outrage?

As if this were not bad enough, banks create illusory profits and capital by using derivatives to game accounting rules under the International Financial Reporting Standards (IFRS). Gordon Kerr explains how in detail here.

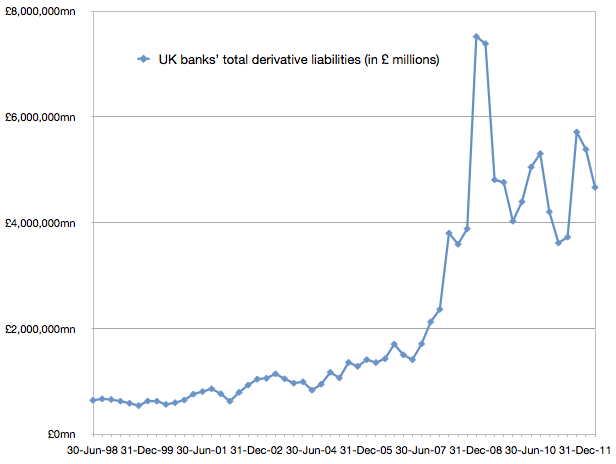

That could be the next outrage. The present LIBOR scandal could look minor when the public discover that banks use derivatives to record as immediate profit monies which have not been received: bonuses will have been paid out of capital or even bailout funds. No wonder UK banks’ derivative exposures surged after IFRS accounting was introduced in 2005:

And without prudent accounts to provide a true and fair view of banks’ financial positions, how are even basic laws to be applied?

What is to be done?

It’s time to privatise commercial risk in banking and insist on prudent accounts.

Risks cannot and should not be eliminated. Society needs a successful, entrepreneurial financial system to provide productive investment. But officials must stop pretending that the consequences of moral hazard can be regulated away. In a free society, people must take responsibility or there will be licence, lawlessness and chaos – just what we are seeing today.

My Financial Institutions (Reform) Bill and my Financial Services (Regulation of Derivatives) Bill would transform the culture of banking, enable a true and fair view and stop exploitation of shareholders and taxpayers by reckless individuals in the system.

There would be no need to claw back bonuses: they would already be treated as capital and taking losses.

Commercial error would receive financial penalties: there would be no calls for criminal law to deal with the consequences of bad business.

And, told well in advance that they would be taking unlimited personal liability for their banks’ losses, you can be sure that bank directors would soon split up our banking behemoths into the smaller, more manageable and competitive institutions that we need – without legislative intervention.

There may be little point in a further independent inquiry. The Vickers Independent Commission on Banking already reported and the Government is legislating but the proposed measures don’t deal with moral hazard or bad accounting. The rewards for risk-taking will still be huge and the risks will still be socialised: does anyone really believe that will lead to lasting cultural change?

Conclusion

David Cameron has said:

The country needs a new direction and new answers. I am clear about the new direction we must set for Britain. To meet the challenges of the twenty-first century, and to satisfy people’s aspirations today, this country needs a responsibility revolution.

Both King and Cameron were right: we have the worst possible banking system and this country needs a responsibility revolution. The LIBOR scandal shows it is time to take serious action. Government and officials should stop pretending they can regulate away the consequences of giving bankers freedom without responsibility. They can’t ((More from Gordon Kerr.)). They should adopt my bills.

A few judicious crucifixions would also serve to curtail many of the worst excesses. Try it, you might like it.