We know people are deeply worried about the Coronavirus – the impact it will have on their jobs, their incomes and their ability to provide for their families. We said we would support the British people – and we meant it. We will do whatever it takes and we will get through this.

Our Plan for People’s Jobs and Incomes, will protect people’s jobs; offer more generous support to those who are without jobs; strengthen the safety net for the self-employed; and help people stay in their homes.

The Government is standing behind employers – and we are asking that they do their bit and stand behind workers.

- We will help pay people’s wages through the Coronavirus Job Retention Scheme – offering grants to employers who promise to retain their staff, covering most of the cost of paying people’s wages.

- We are also deferring the next three months of VAT until the end of the financial year – an injection of over £30 billion of cash to businesses to help businesses pay people and keep them in work.

- We are also acting so that, if the worst happens, there is a stronger safety net to fall back on. So we are increasing Universal Credit and Working Tax Credit by £1,000 a year for the next 12 months – that’s nearly £7 billion of extra support.

We will ensure people get the support they need to do the right thing, to stay at home, protect our NHS, save lives.

Protecting people and their jobs:

Stepping in and helping pay people’s wages – through a scheme which is one of the most generous of any in the world – paying grants to support as many jobs as necessary. Any employer in the country – large, small, charitable or for profit – who promises to retain their staff, can apply for a grant to cover most of the cost of paying people’s wages.

Government grants will cover 80 per cent of the salary of retained workers up to a total of £2,500 a month – above the median income. We will place no limit on these grants. The cost of wages will be backdated to 1 March and will be open initially for at least three months – and we will extend the scheme for longer if necessary.

Extending eligibility for the scheme to the 19 March, meaning thousands more workers can be furloughed rather than let go. To ensure the scheme helps as many people as possible, the date by which somebody had to be employed has been extended from the end of February to 19 March 2020. This change makes the scheme more generous while keeping the substantial fraud risks under control and is expected to benefit over 200,000 employees.

Allowing workers to carry over their statutory annual leave that they don’t use this year because of Covid-19. New regulations will allow up to 4 weeks unused leave to be carried into the next two leave years. The changes will also ensure all employers affected by Covid-19 have the flexibility to allow workers to carry over leave at a time when granting annual leave could leave them short-staffed in some of Britain’s key industries, such as food and healthcare

Introducing a three month mortgage holiday for those in difficulty due to coronavirus – so that people will not have to pay a penny towards their mortgage while they get back on their feet. We will work with trade unions and businesses to develop new forms of employment support to help protect people’s jobs and incomes through this period.

Making Statutory Sick Pay available for people diagnosed with COVID-19 or who are self-isolating, helping people with their finances – and a doctor’s note can be obtained via NHS 111. We have already set out that SSP will be available from day one for people who have COVID-19. But the Budget sets out that this will now cover those who are unable to work because they have been advised to self- isolate as well as for people within the same household who display symptoms. Those who are advised to self-isolate will able to obtain a doctor’s note via NHS 111 as medical evidence for SSP.

Allowing people to obtain a new isolation note online. Isolation notes will provide employees with evidence for their employers that they have been advised to self-isolate due to coronavirus, either because they have symptoms or because they live with someone who has symptoms. The notes can be accessed through the NHS website and NHS 111 online, and then emailed to the user or a trusted friend or family member, or directly to an employer, if someone doesn’t have email.

Updated the guidance so that employees with caring responsibilities can now be furloughed. Employees who are unable to work because they have caring responsibilities resulting from coronavirus can be furloughed. For example, employees that need to look after children can be furloughed.

Offering more generous support to those who are without employment:

Strengthening the safety net for those who need it – increasing Universal Credit and Working Tax Credit by £1,000 a year – a cash injection of nearly £7 billion in the welfare system. We are increasing the Universal Credit standard allowance, for the next 12 months, by £1,000 a year. We will also increase Working Tax Credit by the same amount for the next 12 months. Together these measures will benefit over 4 million of our most vulnerable households.

Supporting people who are not eligible for Statutory Sick Pay, like the self-employed, through the welfare system so that nobody is penalised for doing the right thing. We will make it quicker and easier to access benefits. Those on contributory ESA will be able to claim from day 1, instead of day 8. To make sure that time spent off work due to sickness is reflected in people’s benefits, we are also temporarily removing the minimum income floor in Universal Credit. This means self-employed people who fall out of work will still get their full payment. And we are relaxing the requirement for anyone to physically attend a jobcentre – everything can be done by phone or online.

Suspending face-to-face assessments for all sickness and disability benefits for the next 3 months. This temporary move (effective from 17 March) is being taken as a precautionary measure to protect vulnerable people from unnecessary risk of exposure to coronavirus. We will ensure those who are entitled to a benefit continue to receive support, and that new claimants are able to access the safety net.

Suspending new reviews or reassessments across all benefits for three months. This includes Universal Credit (UC), Employment and Support Allowance (ESA), Personal Independence Payment (PIP), Disability Living Allowance, Attendance Allowance and the Industrial Injuries Disablement Benefit. Where awards are due to expire, we will be extending end-dates so that claimants continue to receive financial support at their current rate during this period.

Helping people stay in their homes:

Providing nearly £1 billion of support for renters, by increasing the generosity of housing benefit and Universal Credit, so that the Local Housing Allowance will cover at least 30 per cent of market rents in local areas.

Standing behind businesses:

Standing behind businesses small and large – providing a £330 billion package of loans and guarantees – that’s worth 15 per cent of our GDP. And if demand is greater than the initial £330 billion we are making available, we will go further and provide as much capacity as required. That means any good business in financial difficulty who needs access to cash to pay their rent, the salaries of their employees, pay suppliers, or purchase stock, will be able to access a government-backed loan, on attractive terms.

We will support liquidity amongst large companies, with a major new scheme being launched by the Bank of England. This has provided almost £1.9 billion of support to firms and a further £1.6 billion has been committed.

We have introduced a Coronavirus Business Interruption Loan Scheme to provide loans of up to £5 million, interest free for 12 months, to small businesses. More than £90 million of loans to nearly 1,000 small and medium sized firms have been approved under the scheme since it was launched last week. But we are going further. The Chancellor has extended the scheme (3 April 2020) so that all small businesses affected by Coronavirus, and not just those unable to secure regular commercial financing, will now be eligible. The Government is also banning lenders from requesting personal guarantees for loans under £250,000.

We have created a new Coronavirus Large Business Interruption Loan Scheme to provide loans of up to £25 million – meaning larger businesses can benefit. This will provide a government guarantee of 80 per cent so that banks can make loans to larger companies. This will give banks the confidence to lend to more businesses which are impacted by coronavirus but which they would not usually lend to. Loans backed by a guarantee under the scheme will be offered at commercial rates of interest.

Helping all businesses in the retail, hospitality and leisure sectors through a £22 billion package – meaning that none of these companies will have to pay business rates. All businesses in this sector are exempt from business rates for 12 months – that’s every single shop, pub, theatre, music venue, restaurant, and any other business in the retail, hospitality or leisure sectors. In addition, we will provide small businesses in these sectors with an additional grant of up to £25,000. Any business with a rateable value of less than £51,000 can now get access to a government grant. Put together, these measures will provide high street businesses with a £22 billion boost.

Exempting estate agents, lettings agencies and bingo halls from paying business rates this coming financial year. We have already announced that the business rates retail discount would be increased to 100 per cent next year and would be expanded to the hospitality and leisure sectors. We have now gone further – some of the exclusions for this relief have been removed, so that retail, leisure, and hospitality properties that have closed as a result of the Covid-19 restriction measures will now be eligible for the relief.

Giving businesses an additional 3 months to file accounts with Companies House, helping companies avoid penalties as they deal with the impact of COVID-19. All businesses will be able to apply for a 3 month extension for filing their accounts – with those citing issues around COVID-19 being automatically and immediately granted an extension. Applications can be made through a fast-tracked online system which will take just 15 minutes to complete.

Providing grants to the smallest of businesses of £10,000. We are providing £10,000 grants to the 700,000 of our smallest businesses.

Protecting commercial tenants by ensuring that, if they cannot pay their rent because of coronavirus, they will not be evicted. These measures, included in the emergency Coronavirus Act, will mean no business will be forced out of their premises if they miss a payment in the next three months.

Supporting small and medium-sized businesses to cope with the extra costs of paying Statutory Sick Pay (SSP) by refunding eligible SSP costs. The criteria for eligible businesses are:

- The refund will be limited to two weeks per employee who has claimed SSP as a result of Covid-19.

- Employers with fewer than 250 employees will be eligible.

- Employers should keep records but should not require employees to provide a doctor’s note.

- The eligible period will commence from the day on which regulations extending SSP come into force.

- We will work with employers over the coming months to set up the repayment mechanism for employers as soon as possible.

Deferring the next three months of VAT tax, a direct injection of over £30 billion of cash to employers, equivalent to 1.5 per cent of GDP. That means no business will pay any VAT from now until the end of June, and they will have until the end of the financial year to repay those bills.

Businesses and self-employed people may be eligible to receive support with their tax affairs through HMRC’s Time to Pay service. Arrangements are agreed case-by-case. Businesses can contact HMRC’s new dedicated COVID-19 helpline from 11 March 2020 for advice.

Relaxing planning rules so pubs and restaurants can operate as hot food takeaways during the coronavirus outbreak. Planning permission is normally required for businesses to carry out a change of use to a hot food takeaway. The Government has confirmed regulations will be temporarily relaxed to enable businesses to deliver this service without a planning application.

Doing more to support companies that may be experiencing difficulties because of Covid-19. We will introduce measures to improve the insolvency system which provides the legal options for companies running into major difficulties, in order to help companies that need to undergo financial rescue or restructuring to keep trading. New rules will mean companies undergoing restructuring can continue to get hold of supplies and raw materials.

Temporarily suspending wrongful trading provisions for company directors. We will remove the threat of personal liability during the pandemic (with retrospective respect from the 1 March 2020). All other checks and balances will remain in force.

Making it easier to hold Annual General Meetings. We will ensure the AGMs can be held safely, including postponing, or moving the AGMs to phone or online using only proxy voting.

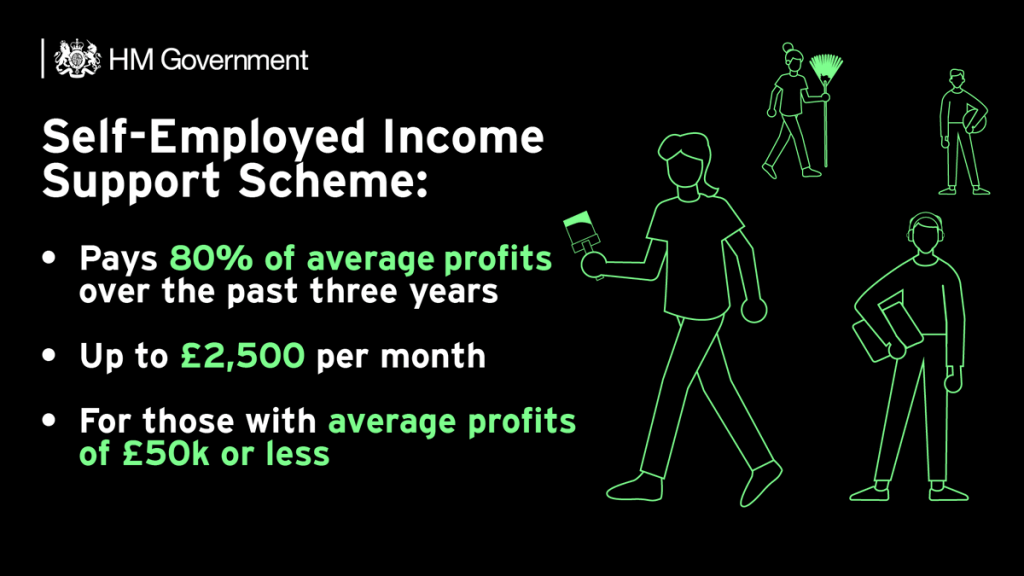

Support for the self-employed

The coronavirus (COVID-19) Self-employment Income Support Scheme will allow people to claim a taxable grant worth 80% of trading profits up to a maximum of £2,500 a month. It will be available for 3 months, but may be extended.

Learn more here.

Supporting charities

The Chancellor has announced a £750 million package of support for frontline charities: HM Treasury announcement of coronavirus funding for frontline charities

The government has also said that charities can access many of the measures the Chancellor previously announced for businesses: Coronavirus (COVID-19) support for businesses

Supporting homeowners and renters

No one who has been impacted by coronavirus should have to worry about getting back on their feet – including homeowners, renters and landlords.

We have announced a package of measures to help people. No homeowner in difficulty due to coronavirus will have to worry about their mortgage. No renter who has lost income due to coronavirus will be forced out of their home, nor will any landlord face unmanageable debts.

These changes will protect all renters and private landlords ensuring everyone gets the support they need at this very difficult time.

We are doing this by:

- Introducing emergency legislation to protect renters, so that no one gets evicted if they cannot pay their rent.

- Introducing a complete moratorium on evictions for the next three months, meaning people do not need to worry about losing their home during this difficult time.

- Announcing nearly £1 billion of support for renters, by increasing the generosity of housing benefit and Universal Credit.

- Introducing a three month mortgage holiday for those in difficulty due to coronavirus – so that people will not have to pay a penny towards their mortgage while they get back on their feet.

- Extending the three month mortgage holiday to landlords whose tenants are experiencing financial difficulty due to coronavirus.