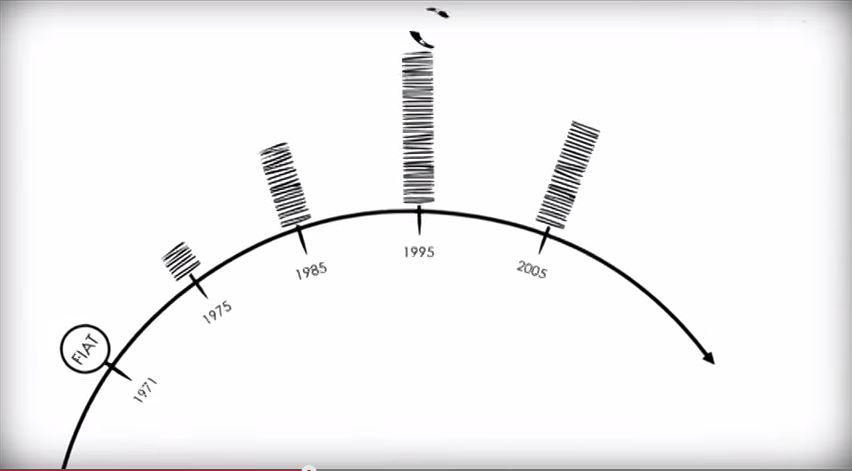

Together with colleagues spanning four parties – Michael Meacher (Lab), Caroline Lucas (Green), Douglas Carswell (UKIP) and David Davis (Con) – I have secured a debate on Money Creation and Society for Thursday 20 November. Here’s a quick guide to understanding the debate. First, we have a system of paper or […]

Read MorePost Tagged with: "economics"

Book review: The Golden Revolution – How to prepare for the coming global gold standard, Butler

Conservative economic policy is easily recognised when stated as balanced budgets, low taxes and sound money. Today, these are a distant prospect. For all the work the Government have done, this year’s net financing requirement is £144.9 billion, larger than the health budget (£140bn) or education (£98bn). As my weekend brief […]

Read MoreThe economic consequences of Scottish separation

I received today a copy of Ewen Stewart‘s paper for the Scottish Research Society, Much Cost, Little Benefit – The economic consequences of Scottish separation. This excellent paper covers currency, debt and borrowing, public spending and taxation, oil revenues, the Scottish banks, trade, population, energy, defence and more. The conclusion […]

Read MoreKeynes, Carney and the corruption of capitalism

We’ve come a long way since the Bank of England’s Andy Haldane pointed out that they had “intentionally blown the biggest government bond bubble in history” and that it constituted the biggest risk to financial stability. Yesterday, in his Sky News interview, the Bank’s Governor Mark Carney said that the housing […]

Read MoreSaving – a foundation of a civilised and progressive society

When we did not reach my Treasury question yesterday — What assessment he has made of the effect of sustained low interest rates on incentives to save; and if he will make a statement. — I asked the supplementary in a topical: Steve Baker (Wycombe) (Con): There is no doubt […]

Read MorePresentation on government policy and the economy, 28 Feb 2014

I’m most grateful to Stupples Chandler Garvey for the opportunity yesterday to present some thoughts on the economy over the next 12 months to local business people. Here are the slides – The UK Economy – the next 12 months:

Read MoreThe Four Horsemen, Russell Brand and the biggest problem with democracy

I found time this morning to watch the film Four Horsemen. It’s about what’s fundamentally wrong with the world and it features some major thinkers from Britain and the world. I feel fairly sure many of them did not know that the central point of the film is to explain […]

Read MoreWhat makes us prosperous? The 2013 Prosperity Index supplies a survey

This morning, after spotting Allister Heath’s boldly optimistic article for the Telegraph, I chaired the Parliamentary launch of the 2013 Legatum Prosperity Index. It’s not enough to consider quality of life by material things alone: Gross Domestic Product neglects great swathes of factors which make life worth living. As the […]

Read MoreSpeech on the “Green Investment Bank”

A speech in committee on the so-called Green Investment Bank, which appears to have had a greater impact than I had forseen: 4.45 pm Steve Baker (Wycombe) (Con): I fear that we are, once again, gathered together to make our constituents poorer and to promote special-interest rent seeking. I am […]

Read MoreBook review: Milton Friedman by Eamonn Butler

I usually romp through Eamonn Butler’s books and Milton Friedman: A concise guide to the ideas and influence of the free-market economist was no exception. The book sets out how Friedman became a public intellectual of worldwide influence, how to end financial crises and how to cure inflation. People, trade […]

Read More