We’ve come a long way since the Bank of England’s Andy Haldane pointed out that they had “intentionally blown the biggest government bond bubble in history” and that it constituted the biggest risk to financial stability.

Yesterday, in his Sky News interview, the Bank’s Governor Mark Carney said that the housing market was the biggest risk to financial stability.

Selected headlines from the recent press continue the story:

- U.K. House Prices Rise to Record High in April – “U.K. house prices hit a fresh record high for a second straight month in April”

- House prices jump £10,000 in five weeks as Bank threatens to cap mortgages – “The price of an average home increased by nearly £10,000 between April and May, the biggest month-on-month cash increase ever recorded.”

- Wage surge and an end to Miliband’s ‘cost of living crisis’ predicted by the Governor of the Bank of England – “Wages, including bonuses, grew by 1.7 per cent in the period January to March compared to a year earlier, while inflation was at 1.6 per cent. … However, if bonuses are disregarded, wage growth was only 1.3 per cent.”

- ‘Dash for trash’ boosts unrated debt sales – “yet another record year for grade-less company debt”

- Bundled debt demand reaching levels of height of crisis – “Sales of bundled US corporate debt known as collateralised loan obligations are on course to surpass levels reached at the height of the credit bubble, as the relentless search for yield leads investors to abandon caution.”

- Buyout frenzy pushes deal prices to fresh highs – “Replenished buyout funds competing for a shrinking pool of large assets are pushing prices of private equity deals to historic highs.”

- Over-heating stock markets raise crash fears – “The number of investors who think the world’s leading stock markets such as the S&P 500 and the FTSE 100 are overvalued has reached its highest level yet”

- Hedge funds haunted by deflation spectre – “And if all else fails there is Ben Bernanke, and the Federal Reserve, to keep the show on the road.”

- Rich double their wealth in five years – “As people have seen their wages fall in real terms, … the 1,000 richest men and women have surged to new heights with their wealth rising by 15.4% on last year’s total of £449bn.”

The underlying issue behind these stories is incredibly straightforward. Easy money policies have resulted in more cash chasing broadly the same assets.

That means bubbles. It means those who are closest to the supply of new money benefitting first. It’s why remuneration exceeds inflation if including bonuses but not excluding them. It’s why London and the South East are suffering a house price boom to an extent the rest of the country is not. It’s why the markets for both bonds and equities are in bubbles and why the richest have doubled their wealth while the rest of us have felt the squeeze. It’s why there are too few assets to buy with available cash, why returns are low and why greater risks are being taken.

I am delighted more people are in work. I’d like to celebrate improvements in standards of living, which of course means lower prices relative to wages, something which is usually labelled “deflation” and fought by the central banks…

We are living through another money-induced boom-bust cycle which will further discredit capitalism by demonstrating one area where Keynes was right: debauching the currency results in an arbitrary rearrangement of riches which strikes at the heart of faith in a market economy.

Headline inflation rates may be low but the structural distortions created by new money are the poison in our system to which we will inexorably succumb.

I still believe what I concluded in my paper for Banking 2020:

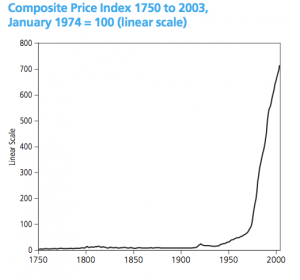

We have lived through an era of monetary history unprecedented in the industrial age. Chronic credit expansion has significantly funded welfare states’ deficit spending while eroding the stock of physical capital. We have come to a profound crisis of political economy: social democracy underpinned by easy money is ending.

That process of conclusion will be marked by a series of bubbles as desperate interventions are applied in an attempt to defibrillate stagnant economies. At some point, it will become apparent that these interventions are futile when some combination of widespread default and massive price inflation takes place. Rapid action will then be necessary to reinstate a basis for sustainable and just prosperity based on free-market capitalism without the systematic intervention in money and bank credit which is even now bringing us to calamity.

Mark Carney and the other monetary masters of our society always sound convincing but monetary policy is not a magic wand to set aside the rules of the real world. These rules will overtake us. Afterwards, we will learn that greater, more sustainable and more just social progress can be achieved with sound money and balanced budgets.

Yes, agreed. But there are some points which also need considering. First of all, even in an economy suffering from market distortions of the kind you are describing – if the market is international then you can have poor monetary policy but if, by comparison to other major economies, you are still better placed – you could potentially prosper as a “best bet.”

Secondly, if the poor monetary policy is coupled with a sensible low-tax environment, you might use it to tide you over until the benefits of that low tax environment become apparent and save the day.

Broadly I’m with you on your entire analysis. But the nature of governments is that if you enacted sensible monetary policy immediately, all the over-leveraged businesses and individuals would begin to crash and burn and you’d get voted out because the solution hurt more than the problem (however much the problem’s ultimate resolution is being delayed.)

Steering a safe path from this point isn’t easy. I doubt anybody knows a quick and painless way to do it. We are where we are.

Both Mark Carney like his predecessor Lord King were so insulting and disparaging to the 26 million savers in the UK many of whom are pensioners who have no other income beyond miserly state pension and the interest from their lifetimes savings.

They used to be able to spend and treat their grandkids but 70% drop in income and the hell caused by FLS has totally destroyed that

They dare not dip into capitol because they have another 30 years retirement to fund

They have seen their fingers burnt by the UNLAWFUL confiscation of NR and B&B shares along with other “safe” investment failures hence dare not take on risk.

They are blazing angry at your government and the totally ignorant and uncaring MPC and nothing George Osborne did in the budget changes that .

FLS was supposed to have stopped in January but int rates have fallen furthur because in truth the FLS taps have not been turned off

The ONS inflation figures are pure fiction

Age Allowance has been scrubbed and their incomes have dropped below even Personal Allowance.

They are denied benefits because they have savings rather than paltry annuities

The list goes on but come the Ballot Box David Cameron and Clegg will feel a very hard and very sharp kick up the rear

In short 26 million of us have had enough of bailing out every Tom Dick and Harry and loosing all that we worked hard and went without for in order to provide cheap mortgages that we never ever got for just 8 million mortgage holders many of whom are buy to let merchants or liar loans

So ignore us at your peril