For City AM, Prof Philip Booth writes, Thatcher changed the City forever but Big Bang isn’t the whole story: Let’s be absolutely clear: in general, the 1980s was not a period of financial deregulation. Insider trading was made illegal in 1980. The life insurance industry, which had been almost free […]

Read MorePost Tagged with: "Financial Crisis"

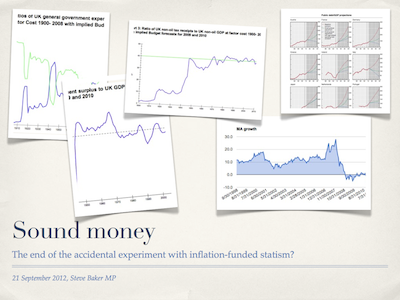

Presentation to Windsor Conservatives

After this morning’s advice bureau, I had the pleasure of visiting Windsor Conservative Association Women’s Group, where I explained what I think are the long term causes of this crisis and what we should do about it. Here are the slides: I was delighted students from a local school joined […]

Read MoreOuch! Ignorance is Bliss, Except when It Hurts – What You Don’t Know About Money and Why It Matters (More Than You Think)

Ouch! — a new book recommended by one of my academic colleagues as widely accessible and very engaging. I understand it “puts most of the books on the crisis churned out by journalists and professionals to shame.” From the jacket: It’s time to wake up or get wiped out. We […]

Read MoreThe awful unspoken truth about QE

Via Conservative Home’s blog The Deep End, an interesting question about QE: If the Government is just going to print money, why can’t we have some? Of course, if you started to give the cash directly to the people, then they might finally understand that our entire economic system runs on […]

Read MoreDocumentary on the financial crisis: The End of the Road

I have just watched a fascinating documentary about the financial crisis by Austrian School thinkers including Peter Schiff, author of the superb book How an Economy Grows and Why It Crashes: Two Tales of the Economy: The End of the Road. It was interesting and easy to follow. It was […]

Read MoreThe UK faces a €149.2 billion liability to the EU

The Bruges Group’s latest report has exposed that the UK is facing a maximum potential loss of €149.2 billion on its financial commitments to the EU and the Euro. The report reveals the full extent of our obligations in respect of the present and future debts of EU institutions including: […]

Read MoreThe transformation of our society: the Labour vote and state spending

Two charts show how our society has been transformed in the last century or so: the party share of the UK popular vote and UK state spending as a proportion of GDP. Via Wikipedia, the parties’ vote shares since about 1830: And via 2020tax.org, an updated chart I have used […]

Read MoreA massive failure of journalism is being corrected

Via It’s austerity all right – but not of the kind we actually need, City A.M.’s Allister Heath makes his case: It has long been a theme of this column that the government and its critics alike have exaggerated the extent of the government’s belt-tightening. The coalition is doing this […]

Read MoreOn double-dip recession, Tullett Prebon rightly ask “What’s the big idea?”

The latest strategy note from Tullet Prebon asks, “What’s the big idea?” with the subtitle “the imperative need for a new ideology”, writing: Effective government is not simply a matter of management. Even in good times, competence is barely enough. In bad times, ideological clarity is imperative, and the lack of […]

Read MorePhilipp Bagus explains how to overcome obstacles to Euro exit

Via Is there no escape from the euro? Intellectual honesty requires us to admit that there are important costs to exiting the euro, such as legal problems or the disentangling of the ECB. However, these costs can be mitigated by reforms or clever handling. Some of the alleged costs are […]

Read More