Via A Golden Way Out of the Monetary Fiasco – Thorsten Polleit – Mises Institute, essential reading for anyone interested in the financial crisis, its causes and a route out (despite its use of the G-word!):

The government-controlled monetary regime — the most destructive force set into motion by state interventionism — has finally been blown to pieces. This is the message conveyed by the monetary fiasco in global capital markets, typically referred to as the international credit crisis.

However, politicians and central bankers the world over are taking great efforts to hide this truth and its full consequences from the public’s attention by taking recourse to even more far-reaching market interventionism.

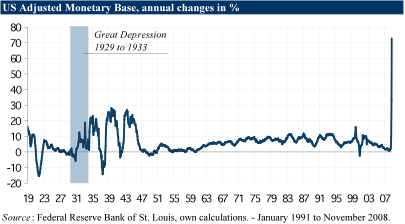

Central banks provide commercial banks with any amount of base money needed to prevent them from defaulting on their payment obligations. The Federal Reserve, for instance, keeps expanding the monetary base at the highest rate seen since 1919 (see graph below).

The article succinctly covers:

- The situation: monetization of paper assets, interest rates, yield spreads, public debt and the risk of government defaults

- The likely future pattern of state intervention

- The causes of the present “fiasco”

- Inflation and deflation

- Returning to free-market money

Highly recommended and it’s perhaps no surprise that Mises’ “The Theory of Money and Credit” is currently sold out at Amazon UK.