It is vital that MPs consider the serious implications of our current public debt commitments and public debt projections. On current projections, the UK will default on its welfare state commitments, including those related to pensions. We must move our debt projections to a sustainable path. The reports that this […]

Read MorePost Tagged with: "Money"

Comprehensive Spending Review 2020

Today, the Chancellor of the Exchequer announced his Comprehensive Spending Review. The review set out the Government departments’ resource budgets for the years 2021/22 to 2023/24. Here are some of the Chancellor’s main points: New funding that takes the budget for coronavirus vaccines over £6 billion, part of over £18 […]

Read MoreAutumn Budget 2017: How the Budget helps Wycombe People

The Chancellor presented his Budget to Parliament yesterday. Many of the Budget measures will positively benefit Wycombe, including The abolition of stamp duty land tax on homes under £300,000 for first-time buyers, New financial support for house building over the next five years, Increases in the National Living and National Minimum Wage, […]

Read MoreCentral banks: the problem or the solution? The Jackson Hole Summit this weekend

In my maiden speech in the Commons, I explained how central banks and easy money produce the economic dislocations which result in the business cycle. As the economics posts on this site attest, I have consistently defended the view that our economic difficulties are rooted in the chronically inflationary system […]

Read MoreThe ECB’s bond-buying programme – “a grave menace to our civilisation”?

The European Central Bank has announced a programme of bond-buying of €60 billion a month, to be carried out at least until end-Sept 2016. Monetary policy around the world remains in the midst of a remarkable experiment: money creation is expected sustainably to solve real economic problems. It is possible that […]

Read MoreSpeech on Money Creation and Society

A lady in Wycombe recently asked me the following questions: Why is my house valued higher than its worth? Why do crashes keep happening every 8 years? Who owns the money supply and how does it relate to gold? Why haven’t I had cost of living pay rise for 7 […]

Read MoreUnderstanding the Money Creation and Society Debate

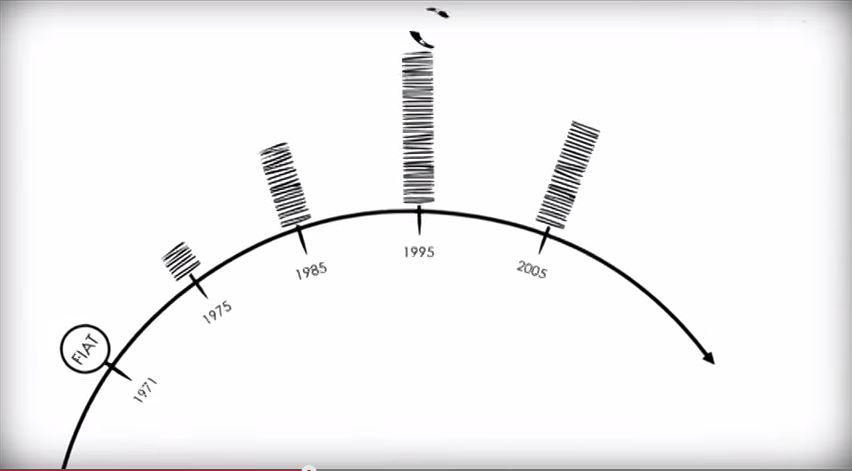

Together with colleagues spanning four parties – Michael Meacher (Lab), Caroline Lucas (Green), Douglas Carswell (UKIP) and David Davis (Con) – I have secured a debate on Money Creation and Society for Thursday 20 November. Here’s a quick guide to understanding the debate. First, we have a system of paper or […]

Read MoreBook review: The Golden Revolution – How to prepare for the coming global gold standard, Butler

Conservative economic policy is easily recognised when stated as balanced budgets, low taxes and sound money. Today, these are a distant prospect. For all the work the Government have done, this year’s net financing requirement is £144.9 billion, larger than the health budget (£140bn) or education (£98bn). As my weekend brief […]

Read MoreKeynes, Carney and the corruption of capitalism

We’ve come a long way since the Bank of England’s Andy Haldane pointed out that they had “intentionally blown the biggest government bond bubble in history” and that it constituted the biggest risk to financial stability. Yesterday, in his Sky News interview, the Bank’s Governor Mark Carney said that the housing […]

Read MoreThe Four Horsemen, Russell Brand and the biggest problem with democracy

I found time this morning to watch the film Four Horsemen. It’s about what’s fundamentally wrong with the world and it features some major thinkers from Britain and the world. I feel fairly sure many of them did not know that the central point of the film is to explain […]

Read More