This post is by Tim Hewish, my Parliamentary Assistant.

A number of Steve’s constituents have written to him regarding the National Insurance Fund (NIF). The Fund was flagged in the media when it lost £4.5bn back in March which is the first time since 1993 that it had decreased. This was largely attributable to an increase in benefit payments and a reduction in National Insurance contributions.

The argument being advocated by a select number of pension lobby groups is that the NIF could pay for the loss in pension funding. Their rationale is because the Fund now stands at £48.5bn and remains significantly above the minimum working level recommended then this surplus can and should be used.

However, The NIF is intended to be the ‘current account’ of the National Insurance scheme, holding sufficient funds to even out fluctuations in the movement of contributions and to provide a source of finance to meet exceptional demands. These demands are meant to be used primarily for unemployment benefit and sickness benefit, although a smaller percentage has been used for retirement pensions.

In addition, the true scale of our public liabilities is estimated at a staggering £6.5trn or £105,177 for every man, woman and child in the UK. One only needs to look at the UK debt trajectory to grasp the unsustainable position that we find ourselves. A Bank for International Settlements working paper, The Future of Public Debt: Prospects and Implications, shows projections of public debt which lead them to conclude that the measures pursued by a number of developed countries are indefensible. Drastic measures are necessary to check the rapid growth of current and future liabilities.

Their findings suggest that unless fiscal policy changes, by 2020 the primary deficit/GDP ratio will rise by 8-10% in the UK and in the next decade the UK Government debt/GDP ratio rise would be 200%, while the fraction absorbed by interest payments would be as high as 27% in the UK.

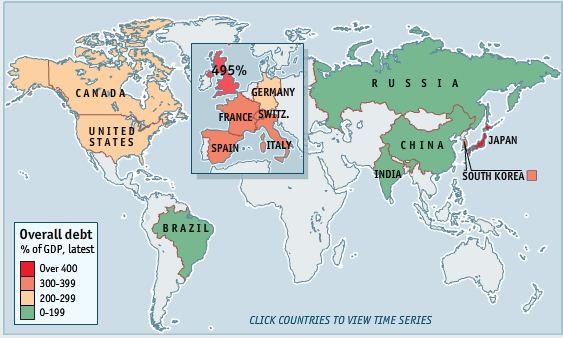

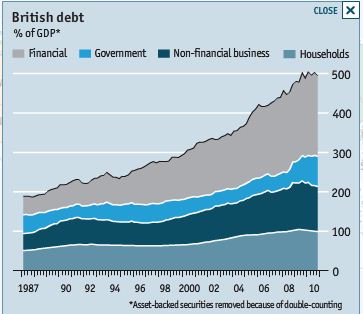

Meanwhile, this Economist chart neatly shows that debt rose across the developed world during the boom, from consumers maxing out credit cards to financial firms taking on more leverage, and that the process of reducing it is still at a very early stage.

The UK’s own debt as a percentage of GDP is crippling: Government debt stands at 78%, Household Debt 100%, Financial debt 205%, and non-financial 115%. This is a total of 495% which is the highest of any nation in the world.

Quick fixes are not going to secure Britain’s economic future. That is why Steve has set up the All Party Parliamentary Group on Economics, Money and Banking that seeks to act as a hotbed of ideas on how to mend our broken socio-economic system.

It might not be a quick fix, but, erm, slash the state. Privatise hospitals, schools. What’s the alternative? We have to reduce the sectors that consume & feed off our production.