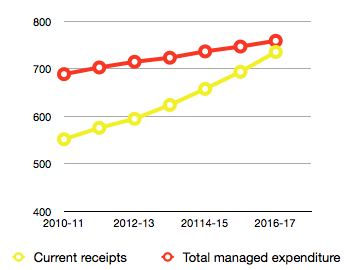

The economic facts behind the Autumn Statement, in as far as they are known or forecast, are available in the Economic and Fiscal Outlook from the Office for Budget Responsibility. Table 4.7 provides forecast current receipts. Table 4.18 provides total managed expenditure. So, here’s a chart of current receipts (i.e. tax) and total managed expenditure (i.e. spending) for the next few years:

The reality is that the Government intend to increase spending every year of the forecast period and to meet that spending with increased revenues. There will only be cuts as a proportion of GDP, and only if it grows. There will only be real cuts if there is inflation.

It’s tragic that we have created for ourselves a state which cannot provide more with more money and that, from the perspective of real public services, there are cuts at all.

There’s much to be said about inflation, inflating the debt away and, indeed, inflating away public expenditure. There’s something fundamentally dishonest about it. That’s why I co-founded The Cobden Centre to press for honest money: our inflationary financial system is undermining society, just as Keynes and Mises said it would.

Keynes wrote,

There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

And Mises explained,

Inflation is the last word in destructionism. The Bolshevists, with their inimitable gift for rationalizing their resentments and interpreting defeats as victories, have represented their financial policy as an effort to abolish Capitalism by destroying the institution of money. But although inflation does indeed destroy Capitalism, it does not do away with private property. It effects great changes of fortune and income, it destroys the whole finely organized mechanism of production based on division of labour, it can cause a relapse into an economy without trade if the use of metal money or at least of barter trade is not maintained. But it cannot create anything, not even a socialist order of society.

We have been plunged into the present misery by a long credit boom caused by low interest rates. Politicians now seem to be helpless in the face of a crisis caused by the inflationary financial institutions they have allowed for the decades following the collapse of Bretton Woods. The only prescription for recovery appears to be more inflation or, as they call it today, “quantitative easing” and “credit easing”.

Yet more money and bank credit may lead to a boom initially, or perhaps merely to a moderation in our difficulties compared to our neighbours, but it is bound to erode the capital stock, to hide losses and to cause a yet worse problem later. The illusion of prosperity created by “monetary activism” cannot last.

If we are to have lasting prosperity and a just socio-economic system, we need instead, as the Chancellor used to say, an economy based on save and invest. That requires, as prerequisites, honest money which holds its value and a state which lives within its means.