In the past few posts, I reproduced the economist Ludwig von Mises’ 1949 explanation of “the crisis of interventionism”, which insisted that the “third way” is a system of economic organisation which cannot last. We must choose between either state socialism or a free society. State socialism would be chaos but “Nothing suggests the belief that progress toward more satisfactory conditions is inevitable or a relapse into very unsatisfactory conditions impossible.”

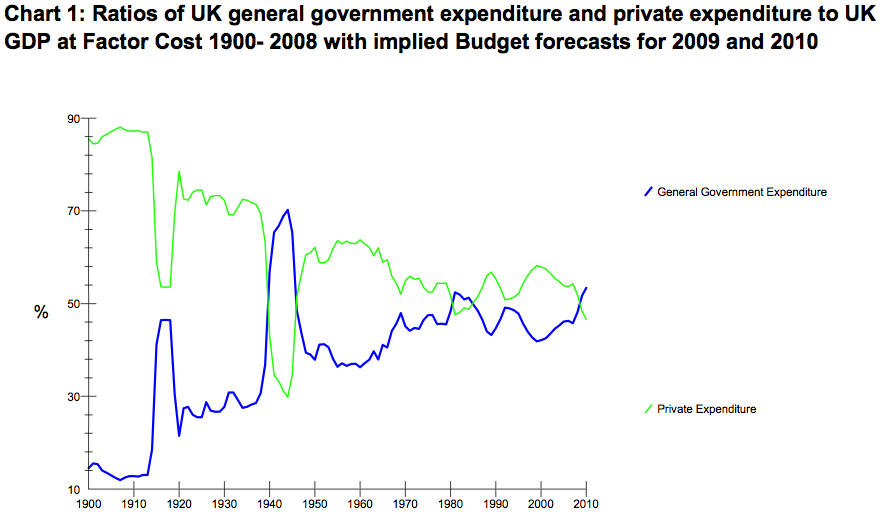

Many seem to believe we are in a crisis of capitalism but, as I have said in the Commons, if this is capitalism, I am not a capitalist. Leaving aside our chronically inflationary system of money and all the damage it has done to society and the economy, any reasonable person looking at the growth of state spending ought to admit that ours is a fundamentally interventionist economy:

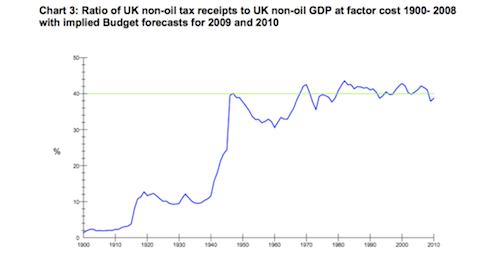

Those of us born after about 1970 have lived exclusively in an age of big government, whoever has been in power: government usually so big it has lived beyond its means. According to charts provided by the same author, total taxation hasn’t been genuinely low since the Second World War:

Commenting on their report Soviet Britain, The Times pointed out that “The state now looms far larger in many parts of Britain than it did in former Soviet satellite states such as Hungary and Slovakia as they emerged from communism in the 1990s, when state spending accounted for about 60% of their economies.”

So, even before beginning to consider the role of the various regulators of major sections of our economy — such as finance, water, energy, transport, media etc — it is obvious that we are not at the end of a century of laissez-faire capitalism. To suggest that this is a crisis of capitalism looks like either an act of wilful misunderstanding or one of denial. Perhaps it is an act of redefinition of the word “capitalism”. In Living with Leviathan, Smith wrote:

It is certainly not being suggested that New Labour economic policy is consciously modelled on pre-war fascist precedents but rather that a combination of the Marxist- inspired New Left ideas of the former student radicals of the 1960s and 1970s, who now compose so much of the Labour Party establishment, when combined with an intense nanny-style authoritarianism, and the practical need to get elected, produced a synthesis that ended up with an economic approach that was functionally hard to distinguish from that of fascism.

And that is the economic system that we have today.

We are in a crisis which has arisen out of the systematic intervention of authority in the cooperation of individuals, families and firms. Quite apart from any other factor, the Bank of England and the world’s other central banks held interest rates too low for too long, creating an illusion of prosperity based on the increasing extension of bank credit. It was not only an illusion which could not last, it was also one which funded the lavish spending of the previous government.

Even now, the governments of the western world are attempting to mitigate the bitterly painful consequences of the errors of the past. As we go through the extremely difficult days ahead, I hope people will increasingly realise that the enemy which delivered us into this mess was the state. If we really care about the poor, the vulnerable and those without hope in our society, we will respond to this crisis by choosing liberty.

Off topic:

Do there currently exist any banks or companies offering “Custodial Deposit Accounts” as described in your and Carswell’s “Financial Services (Regulation of Deposits and Lending) Bill”?

I know a safe-deposit box does the same thing, but that would require me to actually go to a bank: I want something plugged into the network, where I can set up an account and deposit and withdraw over the internet.

(Obviously I would be better off investing my money in something as high risk as possible, since the govt guarantee any investments up to £85,000, no matter how silly.)