Last night’s news coverage of the Bank of England’s prediction of no growth in 2012 was wearily predictable. There were calls for one last rate cut, more “monetary accommodation” and then turning to the Chancellor for more government spending.

We can’t borrow and print our way to prosperity. That’s how we got into this mess: credit was too easy so we had a massive boom which created a poisonous illusion. The bust was inevitable.

The great economist Ludwig von Mises wrote:

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

For now, massive interventions in the credit market continue with more QE recently and now the Funding for Lending scheme. Our masters believe they can manage the economy back to health by encouraging the resumption of credit expansion. Sooner or later, we’ll see whether they or Mises are right.

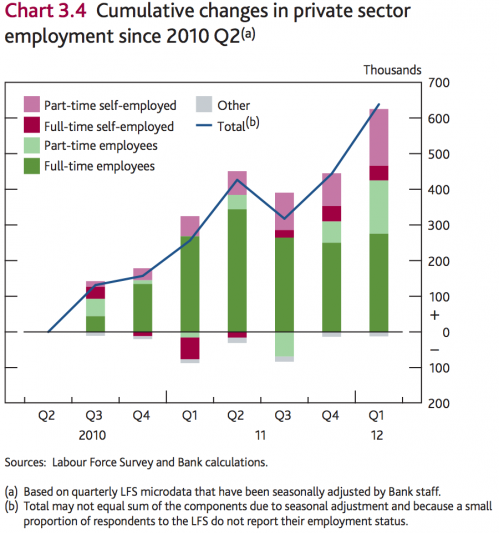

In the meantime, private sector employment is up and no one should be glum about that:

The recent Inflation Report is here.

The problem with these people is they think money is capital. It is not, money represents capital. If we were able to print real capital at no cost, we would be richer (i.e. if we would “print” additional tractors or computers or telephones out of thin air we would be richer).

However since money represents capital, printing more money does not increase the amount of actual capital, so the same nominal amount of money represents less actual capital (i.e. inflation).

Now many will argue that what we need is liquidity. Sure, markets cannot work effectively without proper liquidity, however there is a critical point above which more liquidity will not make a jot of difference to the clearence of the market.

What people don’t realise is that the only way we can make ourselves richer is by producing more or improving the efficiency of the factors of production. Printing money does neither.

It really is that simeple or am I missing something?

Wise words Nick.