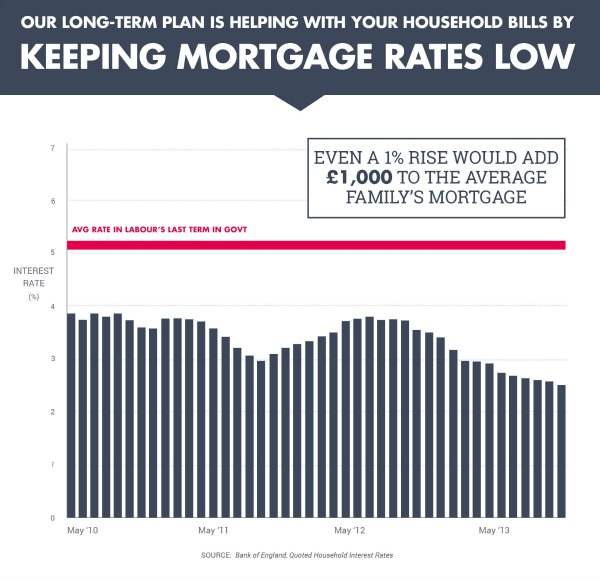

Via ShareTheFacts, number three in a series of charts from the Conservative Party:

It is undoubtedly true that this Government and the Bank of England have worked together to suppress interest rates and that this is good news in the short term for the many thousands of people carrying too much debt thanks to … excessively low interest rates. It’s crushing savers and it’s why we read Britain’s personal debt mountain hits record high of £1,429,624,000,000 as mortgage approvals soar to pre-crash levels.

However, it is absurd that public discourse at once contains condemnation for explicit price fixing in electricity markets while celebrating it in credit markets. In credit markets, as in every other part of our lives, fixing prices has counterproductive side effects. In the case of credit, those effects include the thoroughgoing economic mess in which we find ourselves and the worse crisis I feel sure we will have later when real life catches up with the actions of central banks. I began talking about this in Parliament with my maiden speech and I have not relented in pursuit of explaining the injustice manufactured by our present financial system.

The Government is certainly acting to keep mortgage rates low and that undoubtedly helps hardworking families while it lasts.

But how. Just you, a follower of the Austrian school of economics, go proud of these results!!! Why don’t you criticize the Keynesian management of monetary policy by the Bank of england?

I criticize it continually.